- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

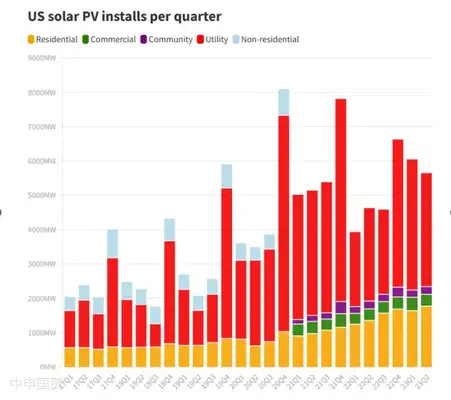

SEIA and Wood Mackenzie recently released the U.S. Solar Market Insight report, predicting that the U.S. solar industry will achieve a record-breaking 32 GW of new capacity this year. The report indicates that in Q2 2023, the U.S. added 5.6 GW of solar capacity, a 20% increase year-on-year, accounting for 45% of the countrys new power capacity in the first half of the year.

Among these, growth in the residential and utility-scale solar sectors was particularly notable. Residential installations added 1.8 GW, while utility-scale projects added 3.3 GW, setting new quarterly records for both sectors. Additionally, the report notes that the U.S. has already connected 12 GW of new capacity in the first half of the year, significantly surpassing the 8 GW added in the same period last year.

The report also highlights that U.S. solar capacity will continue to grow in the long term. Starting in 2024, utility-scale solar is expected to grow at an average annual rate of about 9%. Over the next five years, residential solar is projected to grow at 6% annually, while non-residential solar will grow at 8%. By 2028, the U.S. is expected to reach a total installed capacity of 50 GW.

Among U.S. states, Florida, California, and Texas remain the leaders in solar capacity. Colorado rose rapidly from 26th place last year to fourth place in the first half of this year, largely due to Lightsource bps Sun Mountain project and Meyer Burgers module manufacturing facility.

In contrast, Indiana has seen its ranking decline in recent years, dropping to 40th place in the first half of this year.

On the supply chain front, the Inflation Reduction Act (IRA) has boosted the development of the U.S. solar industrys domestic supply chain. While initial concerns arose about how to develop without Chinese imports, numerous U.S. manufacturers have since invested in domestic cell and module production.

Additionally, the report notes that the global average selling price of solar modules has decreased by $0.01–$0.03 per watt over the past six months, possibly because Chinese manufacturers are seeking new trade partners.

Overall, despite facing many challenges, the prospects for the U.S. solar industry remain bright. Abigail Ross Hopper, CEO of SEIA, stated that the U.S. currently dominates the global clean energy economy and anticipates that the solar and energy storage industries will continue to deliver significant investment returns for the nation in the future.

Related Recommendations

Category case

Contact Us

Email: service@sh-zhongshen.com

Related Recommendations

Contact via WeChat

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912