- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

In October 2024, Kazakhstan announced it would reduce its oil exports to Germany from145,000 tonsto133,000 tons, halting the previous four-month trend of export growth. This decision was mainly influenced by restricted oil transportation routes, particularly bottlenecks involving transit through Russian territory.

Transportation Bottlenecks and Pipeline Limitations

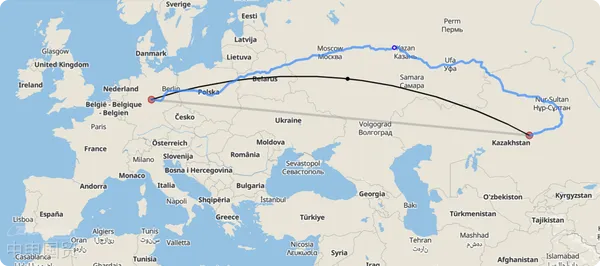

Kazakhstans Ministry of Energy stated that oil must transit through Russian territory before reaching Europe, which directly led to the unavoidable reduction in exports to Germany. Kazakhstans oil pipeline system is connected to Russias, primarily through the Druzhba pipeline built between 1960 and 1964, which transports crude oil to Eastern Europe. Kazakhstans oil export route starts from Uzen City, passes through the Samara sorting center in Russia, is managed by the Russian company Transneft, and finally reaches the Adamova Zastava sorting center in Poland via the pipeline system.

Technical Maintenance and Security Threats

The export reduction is partly due to technical maintenance work at the Kashagan oil field in the Caspian Sea. Additionally, the Samara sorting center was recently attacked by Ukrainian kamikaze drones, further exacerbating uncertainties in oil transportation. These factors collectively made it impossible for Kazakhstan to maintain high oil supplies to Germany and other European countries.

Exploration of Alternative Transport Solutions

Facing transportation bottlenecks, Kazakhstans oil company KazTransOil is actively seeking alternatives. These include utilizing the Baku-Tbilisi-Ceyhan (BTC) pipeline across the Caspian Sea, starting from the port of Aktau, connecting Azerbaijan and Georgia via a 1,768-kilometer route, and finally reaching Turkey, from where oil can be transported to Balkan countries. Reports indicate that from January to September 2024, Kazakhstan and Azerbaijan exported over 50 million tons of oil annually to Europe via the BTC pipeline, equivalent to approximately 1.1 million tons.Reactions from German IndustriesThis news has deeply concerned German industries, with the German government even requesting Kazakhstan to increase oil supplies by 2.5 million tons annually to compensate for the current reduction. Germany relies on stable oil supplies to sustain its vast manufacturing and energy needs, and the reduction in Kazakh exports may put pressure on its industrial production.Impact on the Global Energy MarketKazakhstans reduced oil exports will not only affect energy trade between China and Germany but also trigger ripple effects in the global energy market. As the largest and most economically developed former Soviet republic in the Gulf region, any fluctuations in Kazakhstans oil supply could significantly impact global oil prices and supply chains. Analysts note that if Kazakhstan fails to effectively supplement exports via the BTC pipeline, it may further drive up global oil prices and prompt other oil-producing countries to increase production to fill the market gap.Future Outlook and Policy Recommendations.

As Kazakhstan adjusts its oil export routes, Germany and other European countries must accelerate efforts to find alternative supply sources while strengthening cooperation with other oil-producing nations to ensure energy supply stability. Experts recommend that Europe increase investments in renewable energy to reduce dependence on single oil suppliers, thereby enhancing energy security and market resilience.

This news has deeply concerned German industry, with the German government even requesting Kazakhstan to increase oil supply by 2.5 million tons annually to compensate for the current reduction in exports. Germany relies on stable oil supplies to maintain its vast manufacturing and energy needs, and the reduction in Kazakhstans exports may put pressure on Germanys industrial production.

Impact on the global energy market

The reduction in Kazakhstans oil exports not only affects energy trade between China and Germany but also has a ripple effect on the global energy market. As Kazakhstan is the largest and most economically developed former Soviet republic in the Gulf region, any fluctuations in its oil supply may have a significant impact on global oil prices and supply chains. Analysts point out that if Kazakhstan cannot effectively supplement exports through the BTC pipeline, it may further push up global oil prices and prompt other oil-producing countries to seek increased production to fill market gaps.

Future outlook and policy recommendations

With the adjustment of Kazakhstans oil export routes, Germany and other European countries need to accelerate the search for alternative supply sources while strengthening cooperation with other oil-producing countries to ensure energy supply stability. Experts suggest that Europe should increase investment in renewable energy to reduce dependence on a single oil supplier, thereby enhancing energy security and market resilience.

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912