- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

The world of beverages is like a big melting pot, where various beverages with different flavors and alcohol contents dance together. But did you know? Behind every bottle of beverage, there is a small tax rule. Next, let the editor take you into this magical world of beverages and taxes.

Clarify the tariff structure.

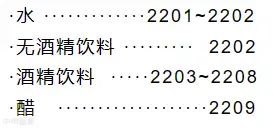

Chapter 22 mainly includes products for drinking, such as water, beverages, alcohol, vinegar, etc.

Main products are classified based on whether they contain alcohol and the source of alcohol. The term non-alcoholic beverages in heading 22.02 refers to beverages with an alcohol concentration not exceeding 0.5% by volume. Alcoholic beverages should be classified under headings 22.03 to 22.06 or heading 22.08.

The recently popular sauce-flavored latte is advertised with main ingredients including water, concentrated coffee, white wine-flavored thick milk (a configured milk beverage), pure milk, light cream, and an alcohol content below 0.5%. It is recommended to classify under tariff code 2202.9900.

Champagne: Romance in bubbles.

Champagne is a wine produced in the Champagne region of France with specific standards, with an alcohol concentration of approximately 9%-14%.

Champagne is made using traditional fermentation methods and has its unique identifier—bubbles.

According to subheading notes, champagne, as a type of sparkling wine, should be classified under tariff code 2204.1000.

PS: Subheading note: The term sparkling wine in subheading 2204.10 refers to wine that, at a temperature of 20°C, exceeds 3 bars of atmospheric pressure in a sealed container.

Sparkling grape juice: More than just ordinary grape juice.

Sparkling grape juice is made from fresh grapes through pressing and filtering, without fermentation, and only carbon dioxide is added to create bubbles, with an alcohol concentration not exceeding 0.5%.

Although named grape juice, it is not classified under tariff code 20.09.

According to the Tariff Notes, grape juice containing carbon dioxide beyond normal levels should be classified under tariff code 2202.9900.

Non-alcoholic beer and fruit beer: New variants of beer.

Non-alcoholic beer is produced using traditional brewing methods but undergoes special processing to significantly reduce alcohol content, classified under HS code 2202.9100.

Fruit beer is an alcoholic beverage between beer and soft drinks. Based on production methods, it can be divided into two types: those with fruit added before fermentation and those with fruit added after fermentation.

Fruit beer with fruit added before fermentation should be classified under HS code 2203.0000, while fruit beer with concentrated fruit juice added after fermentation should be classified under HS code 2206.0090.

Whether its champagne, sparkling grape juice, non-alcoholic beer, or fruit beer, understanding these rules helps us better comprehend tax policies. When declaring to customs, one should thoroughly understand ingredient content and processing methods, classify accurately according to categorization principles, or apply to customs for advance classification rulings.

Related Recommendations

Contact Form

Category case

Contact Us

Email: service@sh-zhongshen.com

Related Recommendations

Contact via WeChat

? 2025. All Rights Reserved. 滬ICP備2023007705號(hào)-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912