- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

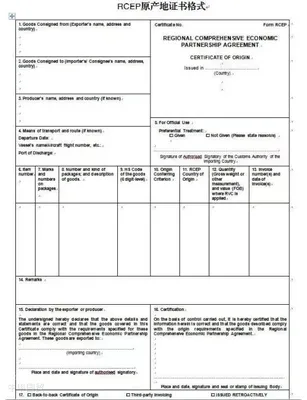

It is recommended to verify through the following methods:The certificate of origin is one of the important documents for enterprises to declare goods in international trade. It serves as proof of the commoditys origin and plays a crucial role in determining tariff treatment, trade statistics, and controlling imports from specific countries. When declaring, enterprises need to pay attention to key details to ensure the validity and compliance of the certificate of origin. This article will introduce the key points enterprises should note when uploading certificates of origin during declaration.

When uploading certificates of origin during declaration, the following points require attention:

Certificate format: Ensure the certificate of origin complies with required formats; otherwise, preferential tariff rates cannot be applied. The certificate must be a color-scanned original with clear and legible content. If the format is non-compliant, enterprises must submit a modification request via the Single Window system, upload a compliant certificate, and retain the original for inspection.

Signatures and seals: The certificate of origin must have complete signatures and seals; otherwise, it will be invalid. If signatures or seals are missing or unclear, enterprises must submit a modification request via the Single Window system, upload a compliant certificate, and retain the original for inspection.

Vessel name and voyage consistency: Ensure the vessel name and voyage number on the certificate match those declared on the customs declaration. If discrepancies exist, verify compliance with the direct shipment principle and provide full transportation documents. For transshipped goods, submit relevant documents per Customs announcements to confirm direct shipment rules. If discrepancies are caused by shipping companies, attach an explanatory statement.

Invoice number and date consistency: Ensure the invoice number and date on the certificate match those on the customs declarations attached invoice. For discrepancies caused by triangular trade, upload commercial documents proving trade relationships and provide an explanatory statement.

Exporter consistency: Ensure the exporter on the certificate matches the invoice and contract. If inconsistent, provide the manufacturers invoice as proof.

Price consistency: If the declared customs value is lower than the FOB price on the certificate, provide proof of authenticity such as payment tax receipts or commercial correspondence, along with an explanatory statement.

Non-compliant issuance date: If the certificates issuance date violates regulations or lacks re-issued markings, contact the issuing authority for amendments.

The above outlines key considerations and solutions for common issues when uploading certificates of origin. For specific trade agreements, conduct checks and operations per agreement requirements. Carefully verify all details during declaration to ensure compliance.

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912