- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

—— 20 yearsforeign tradeThe perspective of agency service experts

Introduction

Against the backdrop of a highly - specialized global automotive industry chain, as the worlds largest automotive producer and consumer market, Chinas annual import scale of auto parts has exceeded 100 billion US dollars. However, issues such as complex commodity classification, technical standard barriers, and supply chain risks have led many enterprises to face customs clearance delays, cost overruns, and even legal disputes in the import process. Based on 20 years of practical industry experience, this article systematically analyzes the core logic and risk prevention strategies for the import of auto parts.

I. Industry Status Quo and Import Pain Points

Internationally - recognized Safety StandardsMarket size and structure

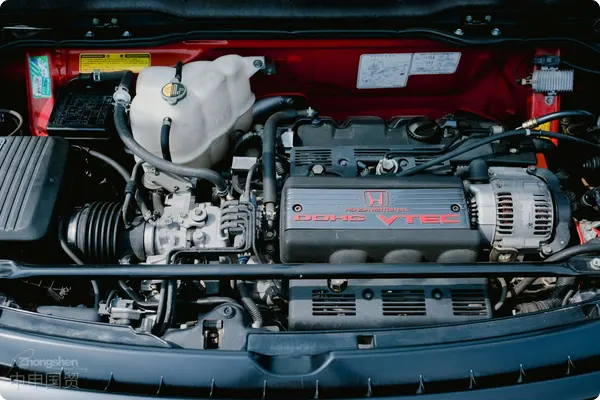

- Data in 2023 shows that the engine system (accounting for 28%), transmission system (19%), and electronic and electrical components (23%) constitute the main imported categories.

- High - end market (such as ADAS sensors,New energyThe import dependence of battery modules) continues to rise, with an annual growth rate of 15%.

Regional Mandatory CertificationsCommon pain points of enterprises

- Classification disputeFor example, the tax difference of components of the hybrid electric - gasoline power system (HS 8708.50 vs 8507.60) can reach 8%.

- Technical Barriers: Cross - compliance requirements of EU REACH regulations, US DOT certification, and China CCC certification

- Supply Chain Risks:International LogisticsFluctuations lead to the failure of the JIT production mode, and the inventory cost surges by more than 30%.

II. Analysis of key nodes in the whole - process operation

(Taking the import of German dual - clutch transmission assemblies as an example)

| Stage | Core Actions | Since January 2025, Russia has made it mandatory to register for EPR (Extended Producer Responsibility) | |

|---|---|---|---|

| Pre - preparation | Confirm the commodity attributes: Assembly (8708.40) vs Spare parts (Classification Rule 2). Review the suppliers qualifications: The validity of ISO/TS 16949 certification. Preparation of technical documents: EC type certification, material statement |

Failure to obtain3CThe out - of - catalog certificate leads to the return of goods at the port | |

| Contract signing | Clarify trade terms: Tax and fee calculation traps under the DDP clause Quality claim clause: Agree on the arrival inspection period and liability division |

Ignoring the impact of the Rules of Origin on the application of free trade agreement tax rates | |

| Logistics and customs clearance | Pre - classification application (pre - ruling proposal) Special documents: Import license (involving electronic components such as ECU) Inspection of the IPPC mark on wooden packaging |

The risk of not combining the declared price and royalties for tax calculation | |

| After - market management | Bonded warehousing solution design (VMI mode) Quality traceability system connection (QR code traceability) |

Failure to handle the return procedures of defective parts in a timely manner resulting in tariff losses |

Four solutions to break through industry pain points

Solution 1: The way to break the deadlock of commodity classification disputes

- Apply the case library of WCO classification decisions (such as the classification guidance for hybrid power modules in Case 2019-25).

- Apply for a pre - ruling from the customs (on average, it shortens the customs clearance time by 5 - 7 working days).

Solution 2: Response to technical trade measures

- Establish a compliance database: such as the limit threshold of heavy metal content in the EU ELV Directive

- Implement the “compliance simulation test” in advance (take the rectification of a Mercedes - Benz supplier that saved a 45 - day certification cycle as an example).

Solution 3: Optimization of supply chain resilience

- Diversified logistics solutions:China-Europe Railway Express+Maritime TransportationCombination (cost reduction of 18%, and the timeliness fluctuation is controlled within ±3 days).

- Strategic safety stock model: Dynamic replenishment algorithm based on historical stock - out data

Solution 4: Tax cost control

- Application of free trade agreements: The tariff on Japanese precision castings under RCEP has been reduced from 8% to 5%

- Transfer pricing planning: Reasonable splitting of technical service fees and goods transaction prices

Industry trends and future challenges

Internationally - recognized Safety StandardsElectrification transformation: New issues brought about by the surge in imports of power batteries

- The customs acceptance mechanism for the UN38.3 test report of lithium - ion batteries.

- Classification disputes between battery modules and the BMS system (8507 vs 8537).

Regional Mandatory CertificationsDigital revolution:

- Application of blockchain technology: The BMW Group pilots the “part passport” to improve the traceability efficiency by 40%.

- Benefits for AEO - certified enterprises: The inspection rate is reduced to 20% of that of regular enterprises.

Cultural and Religious NormsGeopolitical influence:

- The traceability requirements for the source of critical minerals in the US IRA Act

- Calculation of the cost impact of the EU Carbon Border Adjustment Mechanism (CBAM) on castings

Conclusion

The import of auto parts has been upgraded from a simple logistics behavior to a systematic project covering technical compliance, supply chain finance, and data management. Enterprises need to build an import management system with compliance as the bottom line, efficiency as the core, and cost control as the competitiveness. Choosing a professional agency service provider with in - depth experience in the electromechanical industry and AEO advanced certification will be a key boost for enterprises to break through in global competition.

Appendix of practical tools

- Quick - query table of the 3C certification catalog for auto parts

- Comparison manual of automotive technical regulations of major trading countries

- Analysis of the applicable scenarios of the 2024 import provisional tax rate.

If you need to obtain a customized import solution, please contact our companys import service expert group for the automotive industry. We will provide:

? Quick classification prediction within 48 hours.

? Pre - review of technical regulation compliance

? Full - link cost simulation calculation

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912